| View this email as Webpage |

| |||||||||||||||||||||

To be removed from this list please visit manage subscription to unsubscribe. Media LLC |

Fotobloggen - bilder från Forshaga, Skived, Olsäter, Edeby, Mölnbacka med omnejd.

| View this email as Webpage |

| |||||||||||||||||||||

To be removed from this list please visit manage subscription to unsubscribe. Media LLC |

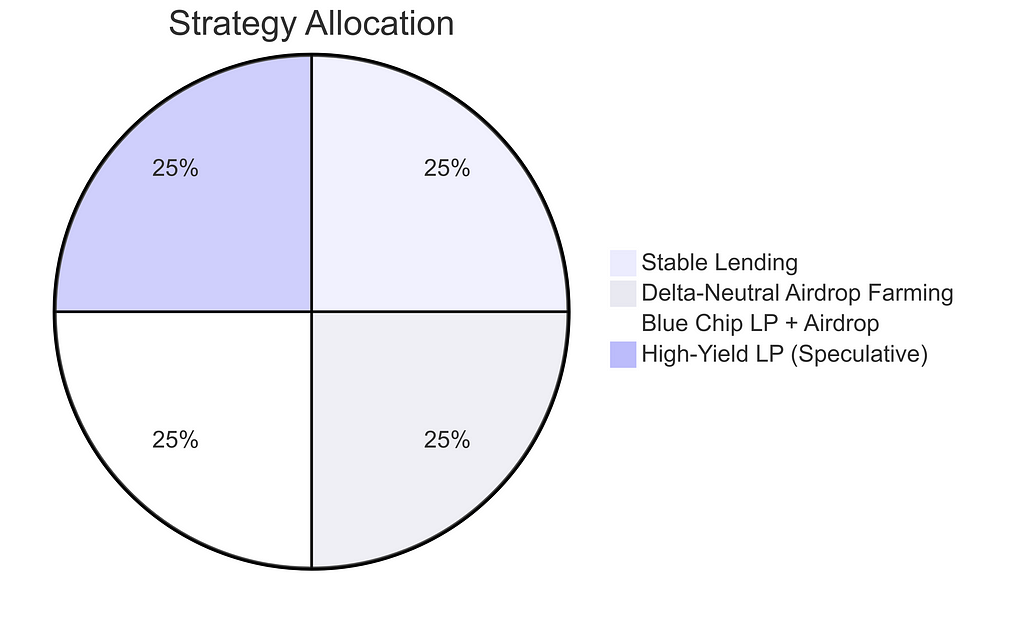

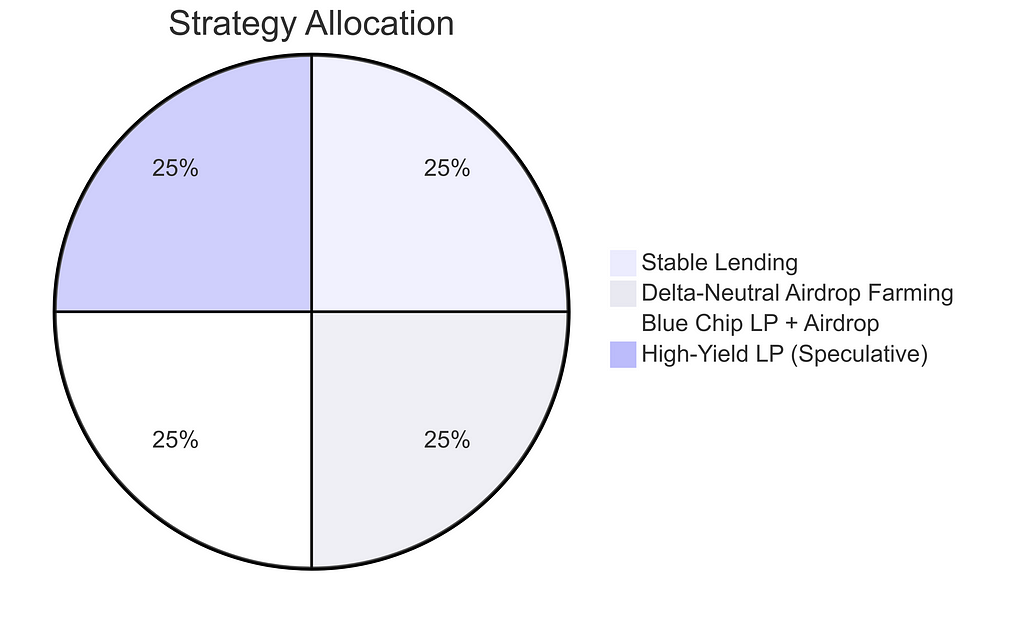

DeFi is an ocean of opportunities, but also a minefield of risks. If you're entering this space with only $1,000 and limited time, the worst thing you can do is gamble it all on speculative tokens. Instead, what you need is a deliberate, strategic approach that maximizes learning, minimizes exposure, and sets you up for long-term success.

This article outlines a practical DeFi plan tailored to those with small capital and tight schedules. You'll discover low-risk strategies, smart airdrop farming, effective liquidity provision, and how to earn passive income with minimal active management — all while building exposure to future opportunities.

If $1,000 is all you can allocate, then it's precious. Don't rush. The first priority is to learn how DeFi works using small amounts — think $10 or $20 — before committing real capital.

Key points:

"Speed is irrelevant if you're going in the wrong direction."

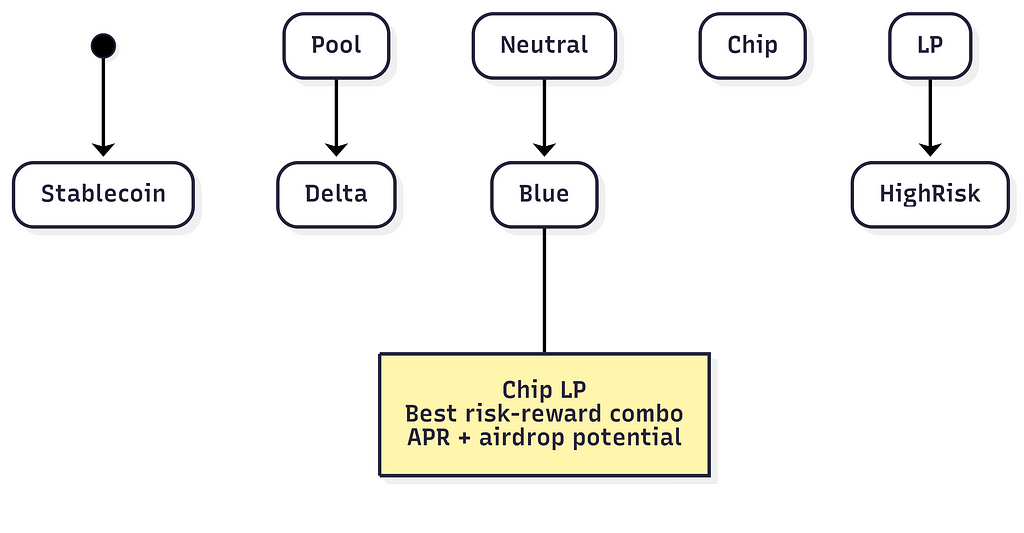

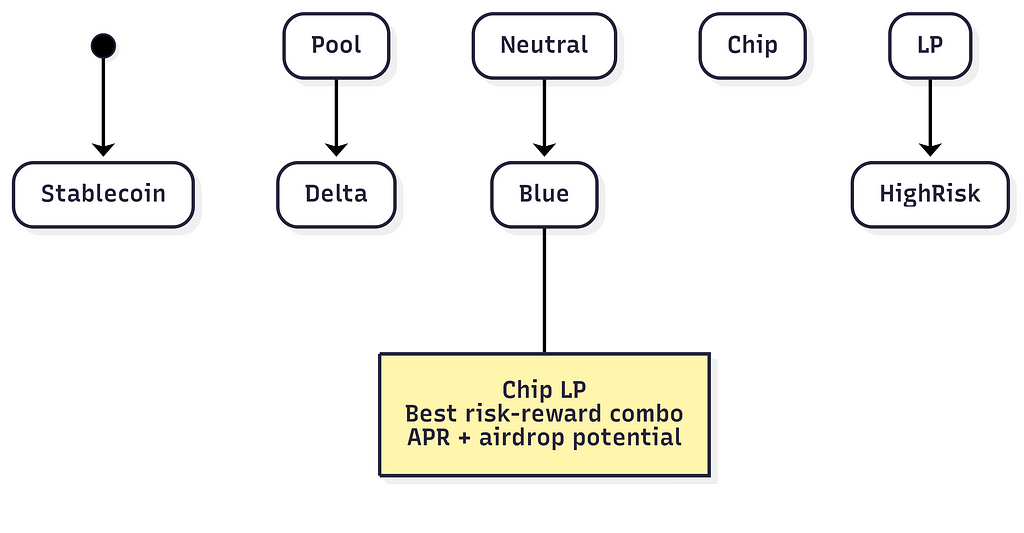

Here are the core strategies available in DeFi today:

Earn APR now + a potential future airdrop — the holy grail of DeFi.

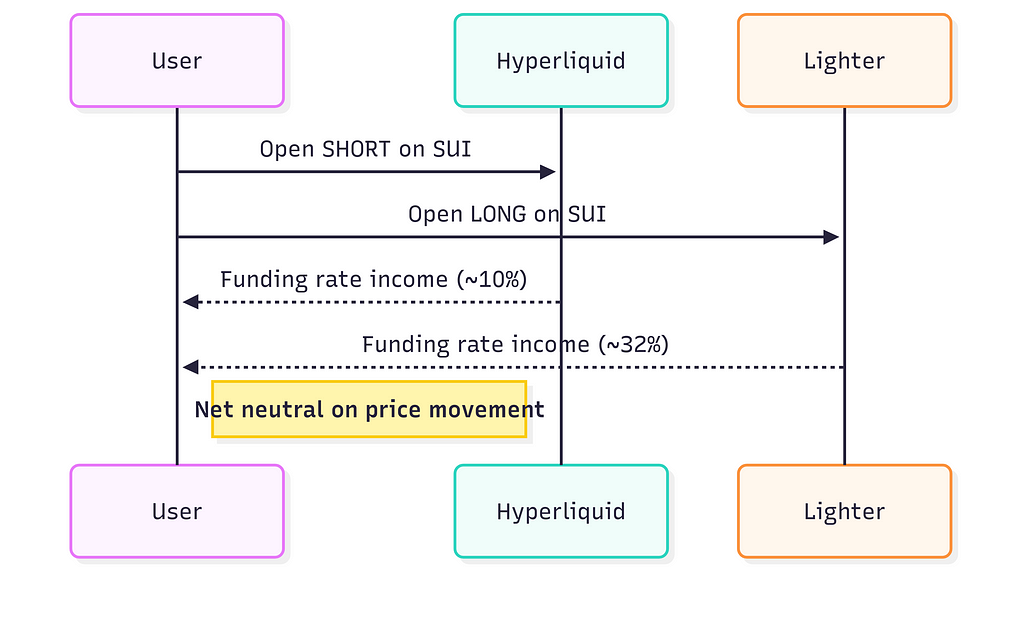

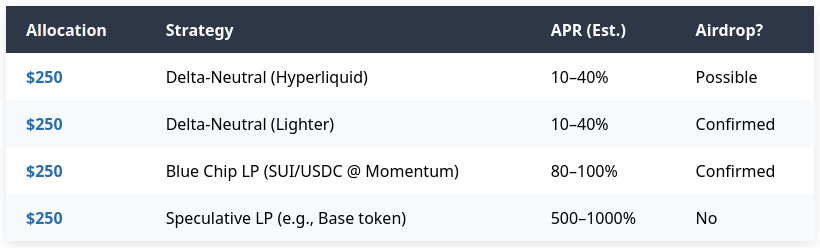

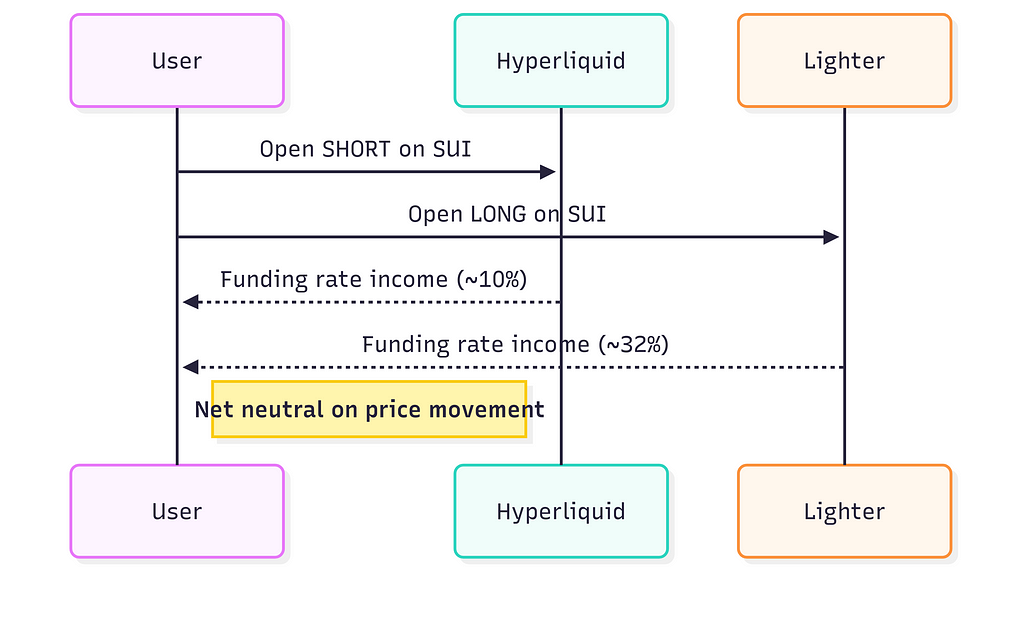

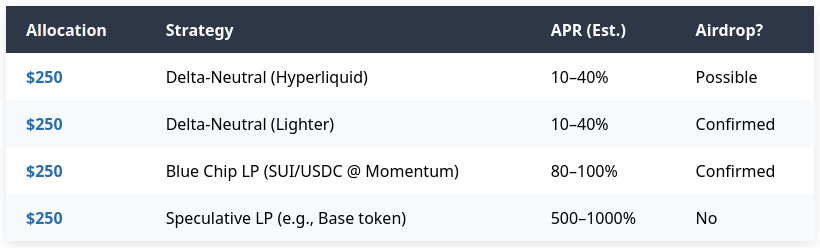

Open mirrored positions across two perpetual DEXes:

Both positions should be set with:

You earn points on Lighter (confirmed airdrop) and potentially on Hyperliquid (based on past behavior).

Pro tip: Maintain positions open longer to maximize airdrop points. It's not just about volume.

Time commitment: ~10–15 minutes/day

Use concentrated liquidity (Uniswap V3-style) on promising DEXs:

Allocate the last $250 to a low-cap token LP on a growing L2 (e.g., Base):

This is NOT for everyone.

Expect volatility, impermanent loss, and wild swings. But if chosen wisely, these LPs can deliver outsized short-term returns.

Here are some platforms and resources worth checking:

Keep an eye on whitelisted beta invites, as access may be limited!

If you're new to DeFi with limited funds and time, you don't need to gamble to grow. The key lies in combining yield generation with airdrop hunting, all while keeping most of your capital in stable, manageable positions.

In under 3 hours per week, you can:

Stay disciplined, track everything, and iterate. Remember: DeFi rewards the curious, the early, and the consistent.

Would you tweak the allocations? Know another DEX with strong airdrop potential? Drop your thoughts in the comments and let's build smarter together.

DeFi is an ocean of opportunities, but also a minefield of risks. If you're entering this space with only $1,000 and limited time, the worst thing you can do is gamble it all on speculative tokens. Instead, what you need is a deliberate, strategic approach that maximizes learning, minimizes exposure, and sets you up for long-term success.

This article outlines a practical DeFi plan tailored to those with small capital and tight schedules. You'll discover low-risk strategies, smart airdrop farming, effective liquidity provision, and how to earn passive income with minimal active management — all while building exposure to future opportunities.

If $1,000 is all you can allocate, then it's precious. Don't rush. The first priority is to learn how DeFi works using small amounts — think $10 or $20 — before committing real capital.

Key points:

"Speed is irrelevant if you're going in the wrong direction."

Here are the core strategies available in DeFi today:

Earn APR now + a potential future airdrop — the holy grail of DeFi.

Open mirrored positions across two perpetual DEXes:

Both positions should be set with:

You earn points on Lighter (confirmed airdrop) and potentially on Hyperliquid (based on past behavior).

Pro tip: Maintain positions open longer to maximize airdrop points. It's not just about volume.

Time commitment: ~10–15 minutes/day

Use concentrated liquidity (Uniswap V3-style) on promising DEXs:

Allocate the last $250 to a low-cap token LP on a growing L2 (e.g., Base):

This is NOT for everyone.

Expect volatility, impermanent loss, and wild swings. But if chosen wisely, these LPs can deliver outsized short-term returns.

Here are some platforms and resources worth checking:

Keep an eye on whitelisted beta invites, as access may be limited!

If you're new to DeFi with limited funds and time, you don't need to gamble to grow. The key lies in combining yield generation with airdrop hunting, all while keeping most of your capital in stable, manageable positions.

In under 3 hours per week, you can:

Stay disciplined, track everything, and iterate. Remember: DeFi rewards the curious, the early, and the consistent.

Would you tweak the allocations? Know another DEX with strong airdrop potential? Drop your thoughts in the comments and let's build smarter together.

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Good day,

I am representing Investment Company offering Corporate and Personal Loan at 3% Interest Rate for a duration of 5 to 25 Years and above.

We also pay 1% commission to brokers, who introduce project owners for finance or other opportunities.

Also if you have any good project that needed funding .Kindly contact us for financing and investment.

Our loans are both for Corporate and private entities at a low ROI of 1.5 to 3%.

We are a private limited firm made up and funded by clientele of Investors and Lenders as its shareholders across all regions, we would be Interested to provide funding for any of your proposals

Yours faithfully,

Mr Arif Menahi

Asst Admin Secretary

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

We can AI your phone system..

We can AI your applications & order taking process..

We can AI your customer service..

Examples - https://www.mclssinc.com

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||